Edition 35: Pass the Cookie

People are spending more time on social (Facebook/LinkedIn/Twitter) yet CPMs are reportedly down by an average of 35% globally.

What gives? All ad exchanges are based on auctions - as advertisers & brands cut down spending across the board & adjust their strategies, the # of advertisers entering these auctions has significantly lowered - the floor has fallen on pricing.

Yet - more & more people are spending time on social to read the news, connect with family & friends and yes watch videos & be entertained. My family is a sample of 2 but I’ve started watching more videos on Facebook. I actively go to ‘Videos’ in my Facebook menu to watch Trevor Noah or news videos.

All this to say - now is the time to be investing in paid social ads if that’s never been part of your mix or you’ve tried but not seen a return, its time to reconsider.

For one of the companies, I work with - we used to have a 70-30 split on Paid Search - Paid Social. Adwords would drive the majority of pipeline + qualified leads & LinkedIn would be a distant second averaging around $220 CPA.

Starting March-April something interesting started to happen:

The volume went up - quality stayed the same & the costs were lower by 50%+. You might be thinking $100 CPA - that’s insanely expensive. That really depends on your business.

The average ACV is $10,000+ / year paid up-front, so they are in a position to re-invest back into more demand gen. Paid CAC (Prospect -> Opp) hovered around $1500 - $2000.

Why am I investing in paid social for most clients? I think there are fewer people actively searching for a problem/solution fit on Google but those same folks are still online reading/watching & chatting with people or working. That’s why LinkedIn (in this case or Facebook/Twitter/YT etc) works better. You can reach people who based on behavior/demographic/interests are likely to be interested in your solution but are not actively searching for it. T

She explained to the astonished newbies that there was an inverted pyramid of advertising, and to date her former employer, Google, had dominated the bottom by monetizing intent (as people did searches). But Facebook, she said, would have an even bigger business, because it had the potential to create and monetize demand. That was the much wider top of the inverted pyramid. People come every day to Facebook to learn what’s new and share their interests. So advertisers would be able to sell to Facebook users things that they wanted even before they thought to ask for them.

But by gathering information about what people were doing on the web—what they were shopping for and fantasizing about—it could also capture the precious information involving people’s intent. That was something advertisers would pay even more for. And it put Facebook in a much more powerful position to capture the lion’s share of online advertising revenue. “The idea that we could move up the chain and do more intent rather than demand fulfillment . . . was pretty fundamental,” Sandberg says.

- Sheryl Sandberg in Facebook the Inside Story (Steven Levy)

Here’s where the difference b/w Paid Search & Paid Social becomes interesting. As Sheryl put it - Google dominates bottom-funnel intent i.e. I am searching for a CRM solution. But with Facebook, I am not expressing my explicit desire to buy a CRM solution but perhaps based on my behavior on/off Facebook I am showing an intent that I am in the ‘market’ for a CRM solution. These signals can be anything from clicking on certain links or visiting certain websites or being involved in certain groups. Google Display solutions have similar solutions to determine who is in the market vs affinity audience. LinkedIn has not matured as much as Facebook/Google in terms of their ad tech - it took them years to add conversion tracking + nonnative placement (Audience Network) but LinkedIn is the work social network so it makes it a breeze to find your audience by demographics.

A brief detour and a trip down history. Digging a little bit into how ad exchanges work - Google popularized it with Adwords & Ad Auctions but it was really Bill Gross of GoTo who pioneered it & Google’s economists & scientists improved it:

In a dynamic marketplace, auctions allow you to find the sweet spot where buyers and sellers both win. The source of their idea was the business model of one of Google’s competitors. GoTo was the brainchild of one of the most fecund minds of the Internet age, an energetic Caltech grad named Bill Gross. Gross’s IQ and geek factor were both off the charts. He began to make a name for himself in the 1980s as an entrepreneur who came up with ideas that applied clever technological tricks, often ones that exploited tempting market niches. During the late 1990s Internet boom, Gross created Idealab, a company that would incubate new companies. He envisioned creating several tech start-ups a year, rolling them out the way a movie studio launches films. During the next few years, several Idealab companies had smashingly successful IPOs—and even more spectacular crashes when the music stopped in 2000. But one Idealab company had emerged as a winner, its search company GoTo. In a way, GoTo was a Bizarro-world version of Google. Whereas Google had skyrocketed to fame as a search engine with innovative technology and no discernable way to make money, GoTo got pans for its search strategy, specifically its mixing of paid and organic search results. But its revenue model was brilliant. Gross’s basic model was Yellow Pages ads, in which businesses paid a premium to place their ads in the relevant category. The biggest impact was made by a full-page ad, and the equivalent of that in a search engine was a high place in search results. Gross’s innovation was to have advertisers compete for those places: to get your ad in the search results under a given keyword, you had to outbid other advertisers in an auction. His colleagues didn’t warm to it. “Everybody in the room had a look on their faces like, ‘You’ve gone nuts.’ But I kept pitching it, and they admitted that there might be something to it, but it would be controversial,” he says. - In The Plex by Steven Levy

Most ad auctions are lowest price auctions - now operate in the same way - advertisers bid on audiences/positions/keywords with the winner paying a cent more than the second-lowest bid.

This is also why you shouldn’t be scared to raise your bids if you do manual bidding but I never do - machines can work the auction much better then humans can with Facebook you can even give it parameters like I want to bid the amount that will result in a steady CPA as you raise your daily budgets.

Speaking of Facebook - the same client has a CPA for $35 on Facebook this last month vs $70 a few months ago.

As a media buyer, the wealth of information advertising platforms & the internet has on my online activity (along with Google) is a gold mine As a consumer, it scares me shitless.

Where does it go from here? There’s a lot of conversation around the future of internet advertising without cookies - I think it’ll affect the ad exchanges (tradedesk?) the most - who rely on 3rd party cookies. With Google/FB - they own the platforms (browser, apps, javascript) & it’ll only increase their monopoly power in the market.

DESPITE THE PUMMELING Facebook was taking, its business had never been better. Its core advertising strategy—which merged the voluminous data it gathered with outside information to help advertisers reach the most promising audiences—was proving unbeatable. After years of developing its techniques and calculating metrics that proved its value, Facebook was the undisputed leader in what was known as PII, or personally identifiable information. Marc Pritchard, P&G’s chief brand officer, remembers a conversation that he had years earlier with Sandberg about cookies, the little data markers that websites plant on your computer when you visit. “I remember very clearly,” he says. “Sheryl said, Cookies are going to die and the future is going to be PII data. The difference is with PII data, you got a lot more to manage than cookie data. Cookie data is anonymous. The future being PII data was right.” Facebook the Inside Story (Steven Levy)

This thread has some interesting responses (including Aazar [hey!]. I think as marketers we sometimes live in our own bubble & decide something works or doesn’t because that is not what works for us. But maybe it’s how customers buy. I personally don’t use G2/Capterra but a few times I’ve done any paid campaigns or really pushed for reviews - it pays off. There’s a reason they’re big businesses (half-owned by Gartner) they provide competitive intel, buying intent + comparisons. Granted it doesn’t work for every segment & granted not everyone reads reviews & buys software that way but I am betting there’s 80% (random number) who check review sites as part of the buying process.

This reminded me of a conversation I had with someone who was against slide-in forms. Vehemently opposed it because she found it annoying but it worked for the customers they sold to.

Ex-Fortune, Polina actually spun off her Fortune newsletter called the Fortune into a standalone newsletter which I believe she runs full-time now.

More & more folks are following the Ben Thompson model, including Lenny Rachitsky (ex Airbnb) who writes about marketplaces:

Staying with Airbnb for a moment - the recent events have been brutal in the travel industry with Airbnb hosts losing money & bookings down 85% compared to last year. This article by The Information raises some interesting questions. Brian Chesky is portrayed as conflict-averse in The Airbnb Story as well & to quote Ben Horowitz - its time for most folks to switch to War Time mode.

If Airbnb has disrupted hotels, travel, space, and trust, it’s also disrupted conventional management theory. One of the unique aspects of the company’s rise is the sheer lack of corporate experience that its founders had when they started out—and the sped-up time frame in which Chesky, Gebbia, and Nathan Blecharczyk (whom Chesky and Gebbia pulled in after that first weekend as their third and technical cofounder) had to learn to become leaders. Very quickly this became a grown-up company with grown-up valuations and expectations—and grown-up problems. Yet, unlike previous companies that grew to this size only to have the founding team split up or “professional” management come in, Airbnb’s three leaders are still together, very much at the helm of the rocket ship they built. The evolution has been the most striking for Chesky, now thirty-five, the company’s CEO. A complete outsider—he lacked not only any knowledge about business but even the tech skills to build anything beyond a basic website—he had to quickly evolve from not knowing what angel investors and slide decks were to steering a $30 billion company with more than 2,500 employees. - The Airbnb Story: How Three Ordinary Guys Disrupted an Industry, Made Billions . . . and Created Plenty of Controversy -Leigh Gallagher

As April Dunford put it (in her Quote RT) ‘Positioning’.

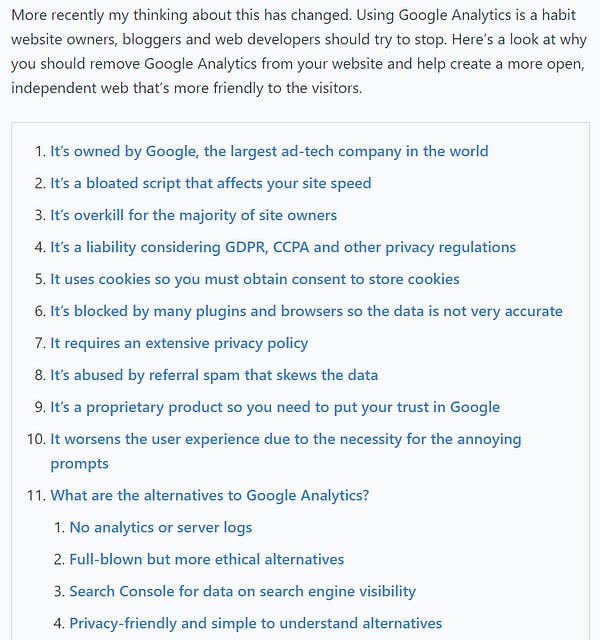

There’s a few (Fanthom/Plausible) that offer a simpler alternative to GA & use privacy as a differentiator. I am sure there are enough folks to make it worthwhile but I always felt like (until recently) 99% of people didn’t give a shit about privacy. The question is are biz owners, privacy warriors, to pay $6/mo for simple analytics vs free GA.

The other side - GA is more than simple traffic analytics (multi-channel attribution reports / App+Web properties etc) which makes it more robust than these privacy-focused tools. But if DuckGoGo can carve out of enough of a market in a world dominated by Google with Bing as a distant second, more power to them!

The soundtrack for this edition was The Great Canadian Bakeoff & my confusion at what day & time it is.

Till next week,

Kamil